Master Your Finances

with our Accounting

Solution

Register For Free Trial

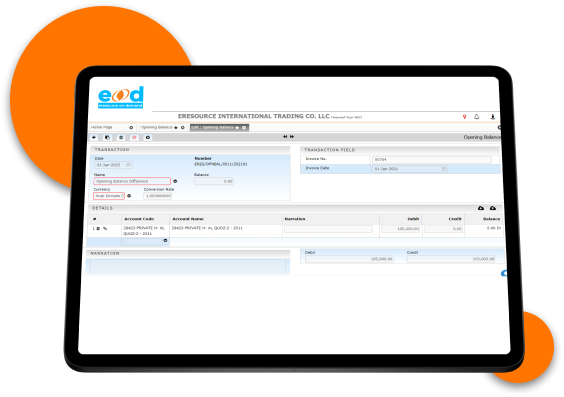

Opening Balance

Opening Balance represents the initial financial balances (both assets and liabilities) at the start of a financial year or when transitioning to eresource On-Demand ERP.

- Initialize opening balance quantities and values during the system setup.

- Update opening balance as needed to reflect accurate financial positions.

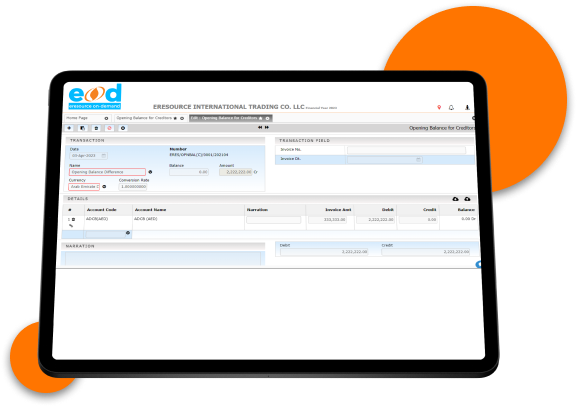

Opening Balance for Creditors

Opening Balance for Creditors refers to the outstanding amount owed to suppliers or creditors at the beginning of a financial period.

- Record the opening balance for creditors when configuring the system.

- Reflect the unpaid amounts to creditors accurately.

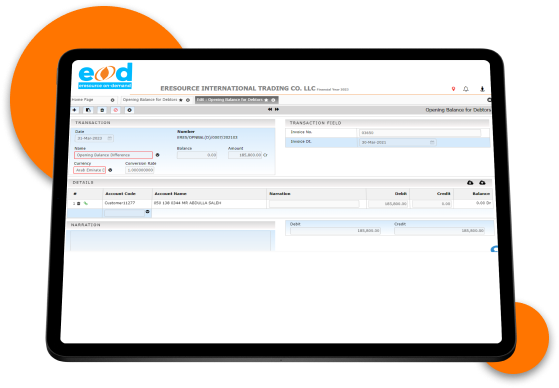

Opening Balance for Debtors

Opening Balance for Debtors represents the outstanding amount receivable from customers or debtors at the start of a financial period.

- Record the opening balance for debtors when configuring the system.

- Ensure accurate tracking of unpaid amounts from customers.

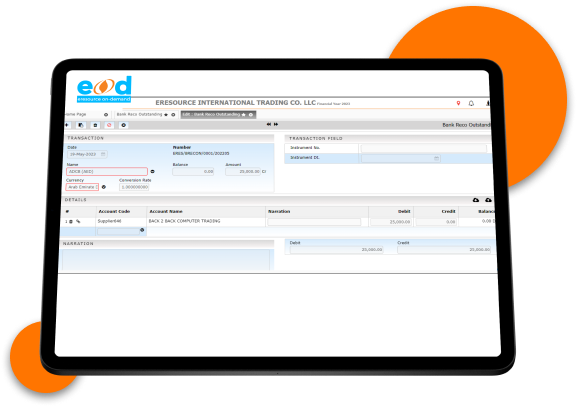

Bank Reconciliation Outstanding Expense Voucher

This component assists in reconciling bank statements by accounting for outstanding expenses that may not have cleared the bank.

- Record outstanding expense vouchers for reconciliation purposes.

- Match these vouchers with bank statements to reconcile accounts.

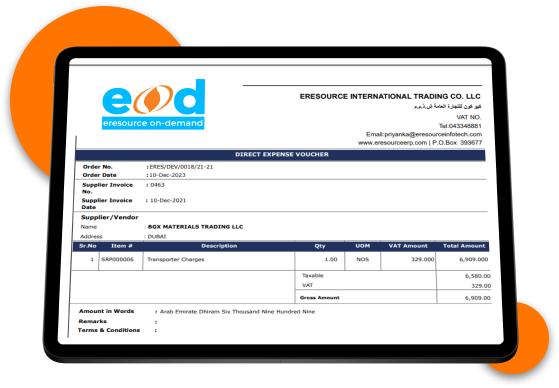

Direct Expense Voucher

Direct Expense Vouchers are used to record expenses incurred directly by the organization.

- Create vouchers specifying expense details, dates, and accounts.

- Ensure accurate expense tracking and reporting.

Office Sales Bank Payment

Record payments received from customers via bank transactions for office sales.

- Document bank payments related to office sales for reconciliation and tracking.

- Update financial records accordingly.

Cheque Bounce

Manage cases where issued cheques are returned or bounced due to insufficient funds or other reasons.

- Record cheque bounce incidents, specifying the reasons and associated financial impacts.

- Adjust financial records to reflect the bounced cheques.

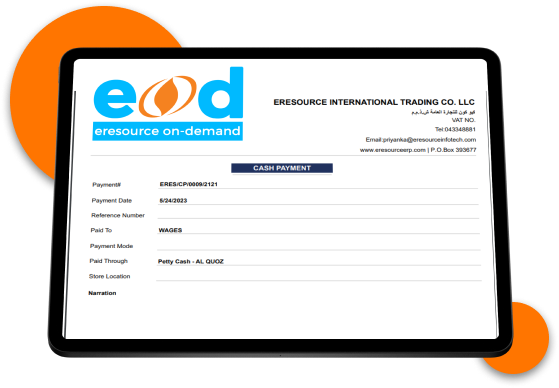

Cash Payment

Cash Payments module allows users to record payments made in cash for various expenses and transactions.

- Create cash payment entries, specifying payment details and accounts.

- Ensure accurate tracking of cash disbursements.

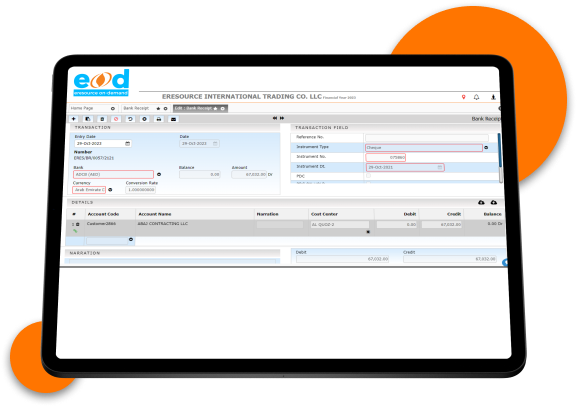

Bank Receipt

Record receipts of funds into the bank from various sources, such as customer payments or income.

- Document bank receipts, specifying the sources and amounts received.

- Update financial records to reflect the bank deposits.

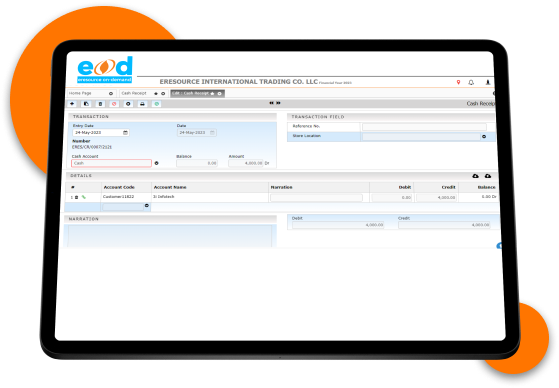

Cash Receipt

Document cash received from various sources, such as sales or other transactions.

- Create cash receipt vouchers specifying receipt details, sources, and accounts.

- Ensure accurate tracking of cash receipts.

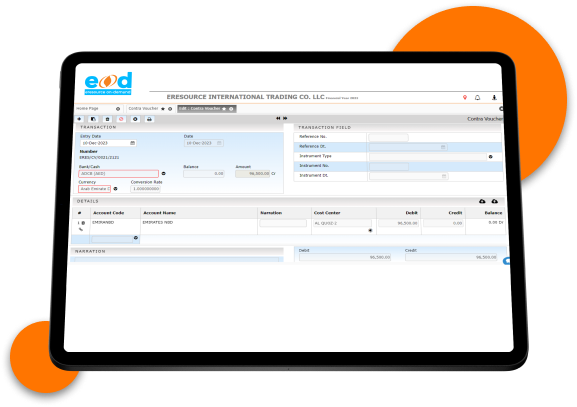

Contra Voucher

Contra Vouchers are used to record internal transactions involving the transfer of funds between cash and bank accounts.

- Create contra vouchers to accurately reflect internal fund transfers.

- Ensure precise accounting of cash and bank transactions.

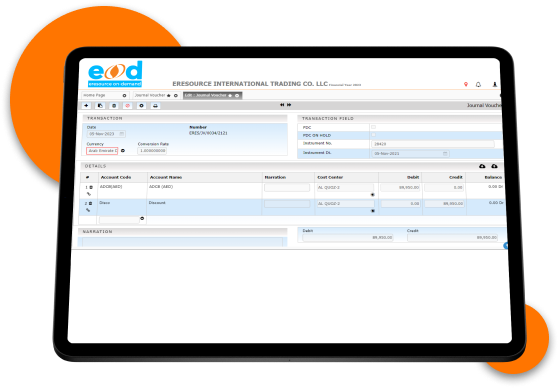

Journal Voucher

Journal Vouchers are used for manual accounting entries to adjust or correct financial records.

- Create journal vouchers for various accounting adjustments or corrections.

- Maintain accurate financial records through journal entries.

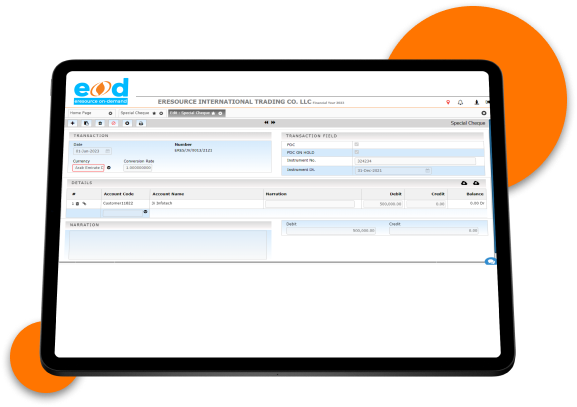

Special Cheque

Special Cheques are used for specific and exceptional financial transactions that require unique handling.

- Create special cheques for non-standard financial transactions.

- Ensure proper documentation and tracking of special transactions.

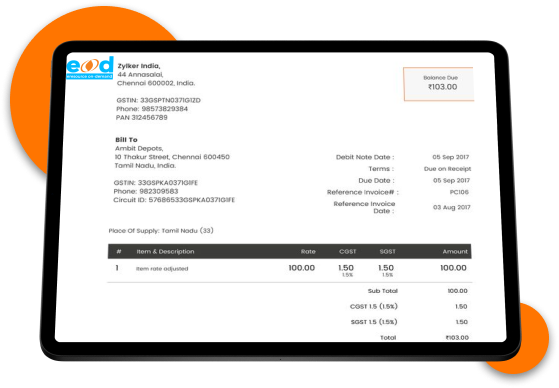

Debit Note against Purchase Invoice

Debit Notes are issued to suppliers to request adjustments or refunds for items received that were damaged or incorrect.

- Generate debit notes against purchase invoices to initiate returns or adjustments.

- Maintain accurate supplier transactions and accounts.

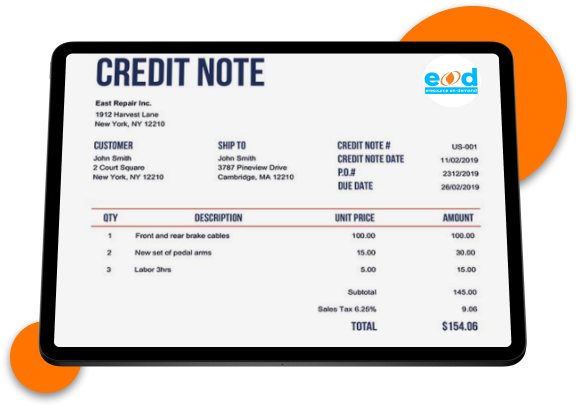

Credit Note Against Sales Invoices

Credit Notes are issued to customers to grant refunds or adjustments for returned or faulty items.

- Create credit notes against sales invoices to process customer returns or refunds.

- Accurately manage customer transactions and accounts.

These components within the Accounts Module in eresource On-Demand play a crucial role in managing financial transactions, ensuring accuracy in accounting, and maintaining financial transparency.

Reports & Dashboards

Credit Notes are issued to customers to grant refunds or adjustments for returned or faulty items.

The Reports & Dashboards in the Accounts module of eresource On-Demand are essential tools for financial management, providing visibility, transparency, and control over the organization's financial data. These features aid in making informed financial decisions, maintaining compliance, and optimizing financial processes.